The Rise Of Mobile Money In Ghana: A Comprehensive Look At Momo Transactions

The Rise of Mobile Money in Ghana: A Comprehensive Look at Momo Transactions

Related Articles: The Rise of Mobile Money in Ghana: A Comprehensive Look at Momo Transactions

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Rise of Mobile Money in Ghana: A Comprehensive Look at Momo Transactions. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Rise of Mobile Money in Ghana: A Comprehensive Look at Momo Transactions

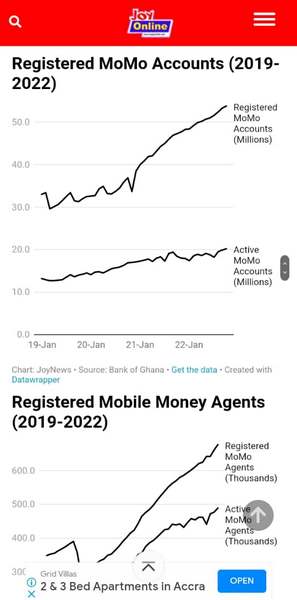

Mobile money, colloquially known as "Momo" in Ghana, has transformed the country’s financial landscape, becoming an integral part of daily life. This mobile-based financial service, primarily offered by MTN Ghana, allows individuals to send and receive money, pay bills, purchase goods, and engage in various financial transactions using their mobile phones. This article delves into the intricacies of Momo transactions in Ghana, exploring its evolution, significance, benefits, and future prospects.

The Genesis of Momo in Ghana:

Mobile money in Ghana emerged in 2009, spearheaded by MTN Ghana with its "Momo" service. The introduction of this service was driven by the need to provide financial services to a significant portion of the population lacking access to traditional banking facilities. Ghana’s rural population, particularly, lacked access to formal financial institutions, making mobile money a crucial tool for financial inclusion.

The Mechanics of Momo Transactions:

Momo transactions rely on a simple and user-friendly interface. Users register for a Momo account by providing their mobile phone number and a valid ID. They can then deposit funds into their Momo wallets through various channels, including mobile money agents, banks, or directly from their bank accounts. Once funds are deposited, users can send money to other Momo users, pay bills, purchase airtime, and even withdraw cash from designated agents.

Benefits of Momo Transactions in Ghana:

The widespread adoption of Momo in Ghana is a testament to its numerous benefits:

-

Financial Inclusion: Momo has significantly improved financial inclusion, particularly for the unbanked population. It offers a convenient and accessible way to manage finances, making essential services like bill payments and money transfers readily available.

-

Convenience and Accessibility: Momo transactions eliminate the need for physical visits to banks or financial institutions. Users can conduct financial transactions anytime, anywhere, as long as they have network coverage.

-

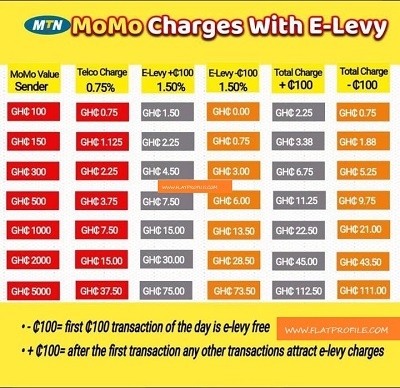

Reduced Costs: Momo transactions often incur lower fees compared to traditional banking methods, making financial services more affordable for a larger population.

-

Economic Empowerment: Momo has empowered individuals and businesses by providing them with greater control over their finances. Entrepreneurs can utilize Momo for business transactions, facilitating easier access to capital and streamlining payment processes.

-

Government Services: The government has embraced Momo as a platform for delivering public services. Citizens can pay taxes, utility bills, and other government fees through their Momo accounts, enhancing efficiency and transparency in public service delivery.

The Impact of Momo on the Ghanaian Economy:

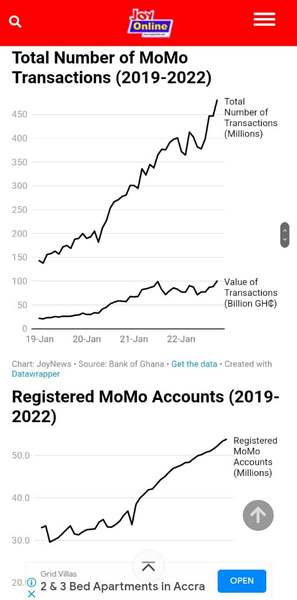

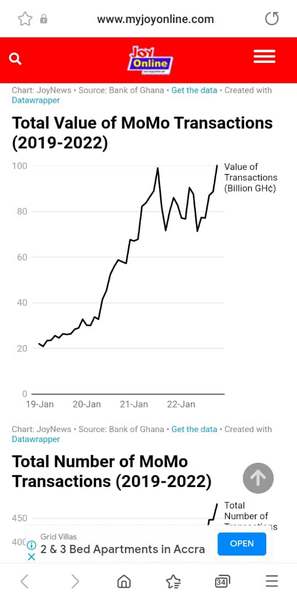

Momo has had a profound impact on the Ghanaian economy, contributing to various sectors:

-

Increased Financial Activity: Momo has stimulated financial activity by providing a secure and convenient platform for financial transactions, contributing to economic growth.

-

Job Creation: The mobile money ecosystem has created numerous jobs, from agents to technicians and customer service representatives.

-

Enhanced Financial Literacy: The widespread use of Momo has led to increased financial literacy among Ghanaians, as they become more familiar with financial concepts and transactions.

-

Innovation and Entrepreneurship: Momo has fostered innovation in the financial sector, encouraging the development of new financial products and services tailored to the needs of the Ghanaian population.

Challenges Faced by Momo Transactions:

Despite its numerous benefits, Momo transactions also face certain challenges:

-

Cybersecurity Concerns: The increasing reliance on mobile money has raised concerns about cybersecurity threats, such as fraud and data breaches.

-

Financial Literacy Gaps: While Momo has fostered financial literacy, there are still gaps in understanding financial concepts and managing finances effectively.

-

Regulatory Framework: The rapid growth of Momo has led to the need for a comprehensive regulatory framework to ensure consumer protection and mitigate risks associated with mobile money transactions.

The Future of Momo in Ghana:

Momo is expected to play an increasingly vital role in Ghana’s financial landscape. The future of Momo is characterized by:

-

Expansion of Services: Momo providers are continually expanding their service offerings, including micro-loans, insurance products, and investment opportunities.

-

Integration with Other Technologies: Momo is expected to integrate with other technologies, such as blockchain and artificial intelligence, to enhance security and efficiency.

-

Financial Inclusion for All: Momo aims to reach underserved populations, particularly in rural areas, to ensure financial inclusion for all.

FAQs on Momo Transactions in Ghana:

Q1: How do I register for a Momo account?

A1: To register for a Momo account, you need a valid mobile phone number and a valid ID. Visit a designated Momo agent or follow the registration process on the MTN mobile money app.

Q2: How do I deposit money into my Momo wallet?

A2: You can deposit money into your Momo wallet through various channels, including:

- Momo agents: Visit a nearby Momo agent and deposit cash.

- Bank transfer: Transfer money from your bank account to your Momo wallet.

- Direct deposit: Some employers offer direct deposit options into Momo wallets.

Q3: How do I send money to another Momo user?

A3: To send money to another Momo user, simply dial *170# and follow the prompts. You will need to enter the recipient’s mobile number and the amount you want to send.

Q4: How do I pay bills using Momo?

A4: To pay bills using Momo, dial *170# and follow the prompts. You will need to select the bill type (electricity, water, etc.) and enter your account number.

Q5: How do I withdraw cash from my Momo wallet?

A5: To withdraw cash from your Momo wallet, visit a designated Momo agent and provide your mobile phone number and the amount you want to withdraw.

Tips for Safe and Secure Momo Transactions:

- Protect your PIN: Never share your Momo PIN with anyone.

- Use strong passwords: Create a strong password for your Momo account and keep it confidential.

- Beware of scams: Be cautious of suspicious messages or calls requesting your PIN or personal information.

- Update your software: Ensure your mobile phone and Momo app are updated with the latest security patches.

- Report suspicious activity: Immediately report any suspicious activity to your mobile money provider or the relevant authorities.

Conclusion:

Momo transactions have revolutionized financial services in Ghana, providing a convenient, accessible, and cost-effective way to manage finances. From financial inclusion to economic empowerment, Momo has had a profound impact on the lives of Ghanaians. As technology continues to evolve, Momo is expected to play an even greater role in the future, shaping the financial landscape of Ghana and driving further economic growth.

Closure

Thus, we hope this article has provided valuable insights into The Rise of Mobile Money in Ghana: A Comprehensive Look at Momo Transactions. We hope you find this article informative and beneficial. See you in our next article!