Navigating The Digital Landscape: Understanding Online Job KYC & Tax Forms

Navigating the Digital Landscape: Understanding Online Job KYC & Tax Forms

Related Articles: Navigating the Digital Landscape: Understanding Online Job KYC & Tax Forms

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Digital Landscape: Understanding Online Job KYC & Tax Forms. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Digital Landscape: Understanding Online Job KYC & Tax Forms

In the digital age, where online platforms facilitate a vast array of transactions, the need for robust verification and compliance measures has become paramount. This is particularly true in the realm of online employment, where platforms connecting employers and workers necessitate a system to ensure the authenticity and legitimacy of both parties. This is where the concept of Know Your Customer (KYC) and tax form submission come into play.

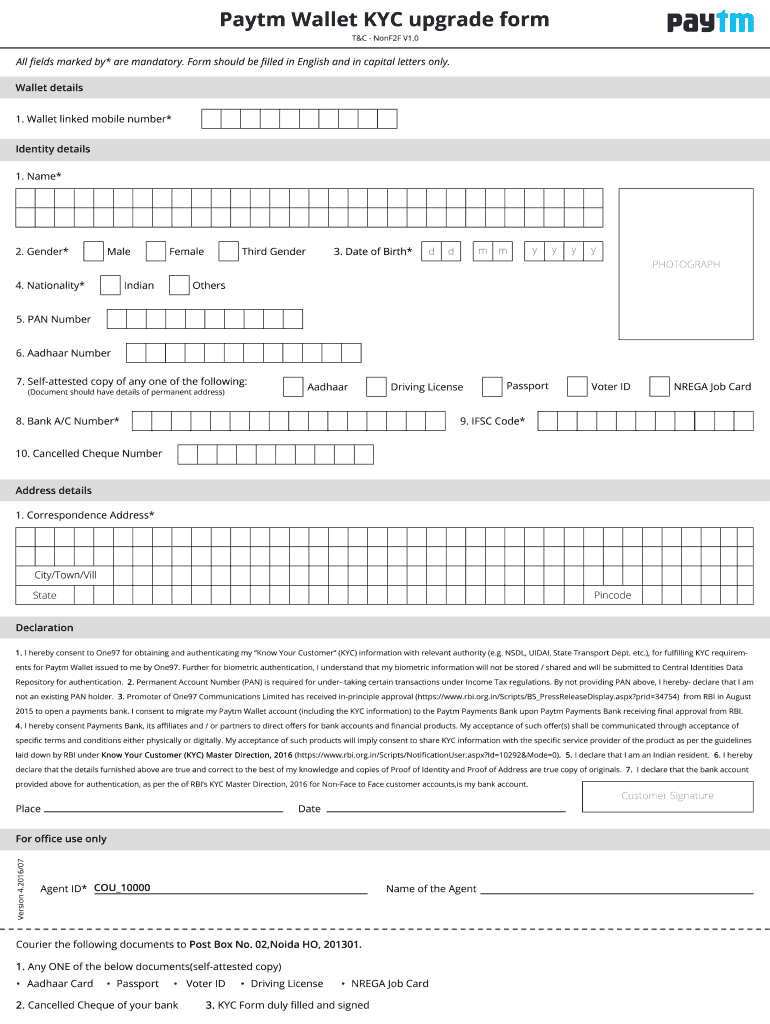

KYC: The Foundation of Trust

KYC, a widely adopted practice in financial institutions, has extended its reach to online employment platforms. The core principle of KYC revolves around verifying the identity and background of individuals engaging in transactions. In the context of online jobs, KYC ensures that both the employer and the worker are who they claim to be, fostering a secure and trustworthy environment.

The Role of Tax Forms

Tax forms, an integral part of any employment arrangement, are essential for financial transparency and legal compliance. Online platforms facilitate the submission of tax forms, enabling employers to withhold taxes accurately and workers to claim their rightful deductions. This process streamlines tax compliance and ensures that both parties fulfill their legal obligations.

Benefits of Online Job KYC & Tax Form Submission

The integration of KYC and tax form submission into online job platforms brings forth numerous advantages:

- Enhanced Security: KYC procedures effectively mitigate the risk of fraudulent activities, protecting both employers and workers from scams and identity theft.

- Increased Trust: By verifying the identities of all parties involved, online job platforms foster a culture of trust and transparency, encouraging genuine interactions and collaborations.

- Streamlined Compliance: The online submission of tax forms simplifies the tax compliance process, eliminating the need for physical paperwork and facilitating accurate tax withholding.

- Improved Efficiency: Online platforms automate the KYC and tax form submission process, saving time and effort for both employers and workers.

- Global Reach: Online job platforms allow for seamless cross-border employment, enabling workers and employers to connect and collaborate across geographical boundaries.

FAQs: Addressing Common Concerns

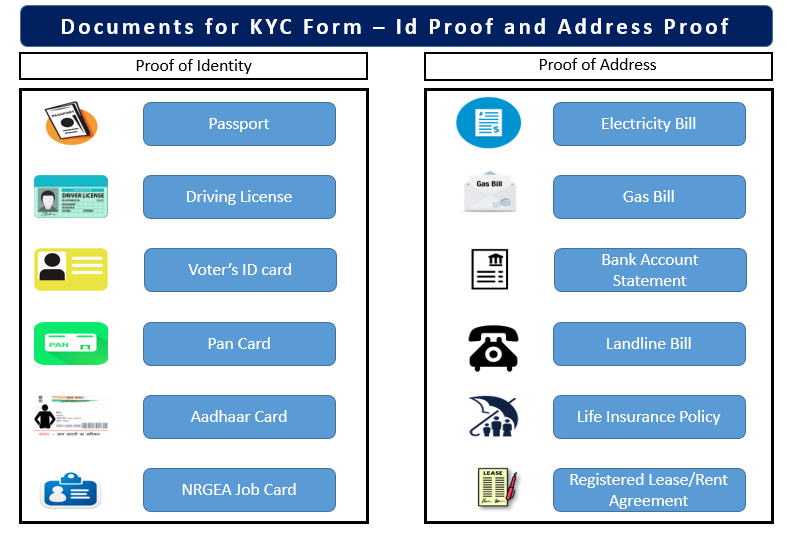

1. What information is typically required for KYC verification?

KYC verification typically requires basic personal information, including name, address, date of birth, and government-issued identification documents. Some platforms may also request additional information, such as employment history or financial records, depending on the nature of the job and the platform’s specific policies.

2. How secure is my personal information when submitted online?

Reputable online job platforms prioritize data security and employ robust encryption protocols to protect sensitive information. It is essential to choose platforms with a proven track record of data security and privacy practices.

3. What are the consequences of providing false information during KYC verification?

Providing false information during KYC verification can lead to account suspension, legal repercussions, and potential criminal charges.

4. What happens if I am unable to submit my tax form online?

Most online job platforms offer alternative methods for submitting tax forms, such as uploading scanned documents or contacting customer support for assistance.

5. How can I ensure that the online job platform I am using is legitimate?

Research the platform thoroughly, read reviews from other users, and check for security certifications and data privacy policies.

Tips for Navigating Online Job KYC & Tax Form Submission

- Choose reputable platforms: Opt for platforms with established reputations, positive user reviews, and a strong commitment to security and privacy.

- Verify platform legitimacy: Research the platform’s background, check for security certifications, and review their privacy policy.

- Provide accurate information: Ensure that all information provided during KYC verification is accurate and up-to-date.

- Secure your account: Choose strong passwords, enable two-factor authentication, and be cautious of suspicious emails or links.

- Report any suspicious activity: If you encounter any issues or suspect fraudulent activity, report it to the platform immediately.

Conclusion: A New Era of Digital Employment

The integration of KYC and tax form submission into online job platforms represents a significant step forward in the evolution of digital employment. These measures not only enhance security and compliance but also foster trust and transparency, paving the way for a more secure and efficient future of online work. As the digital landscape continues to evolve, the importance of robust KYC and tax form submission procedures will only grow, ensuring a more secure and trustworthy environment for both employers and workers alike.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Digital Landscape: Understanding Online Job KYC & Tax Forms. We thank you for taking the time to read this article. See you in our next article!