Mobile Money In Ghana: A Comprehensive Guide To Charges And Fees

Mobile Money in Ghana: A Comprehensive Guide to Charges and Fees

Related Articles: Mobile Money in Ghana: A Comprehensive Guide to Charges and Fees

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Mobile Money in Ghana: A Comprehensive Guide to Charges and Fees. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Mobile Money in Ghana: A Comprehensive Guide to Charges and Fees

- 2 Introduction

- 3 Mobile Money in Ghana: A Comprehensive Guide to Charges and Fees

- 3.1 The Essence of Momo Charges

- 3.2 A Detailed Breakdown of Momo Charges

- 3.3 Understanding the Importance of Momo Charges

- 3.4 Frequently Asked Questions (FAQs) about Momo Charges

- 3.5 Tips for Managing Momo Charges Effectively

- 3.6 Conclusion

- 4 Closure

Mobile Money in Ghana: A Comprehensive Guide to Charges and Fees

![GhanaPay: Bank-wide mobile money service [Ultimate Guide]](https://www.jbklutse.com/wp-content/uploads/2022/06/ghanapay-768x384.png)

Mobile money, colloquially known as "Momo," has revolutionized financial transactions in Ghana. It provides a convenient and accessible platform for sending and receiving money, paying bills, and engaging in various financial activities. While the service offers significant benefits, understanding the associated charges is crucial for maximizing its utility. This article aims to provide a comprehensive overview of Momo charges in Ghana, exploring their intricacies and importance in the broader financial landscape.

The Essence of Momo Charges

Momo charges represent the fees levied by mobile money service providers for facilitating transactions. These charges vary depending on the specific service, transaction amount, and provider. While some charges might seem insignificant, understanding their nuances is essential for managing finances effectively and making informed decisions.

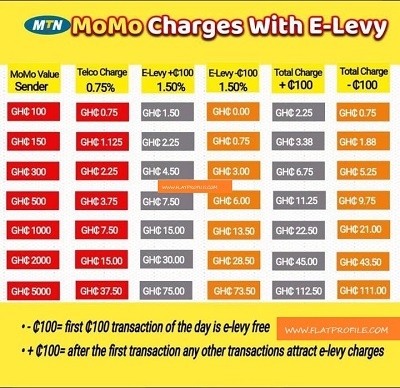

A Detailed Breakdown of Momo Charges

1. Sending Money:

- Inter-Network Transfers: Sending money to a different mobile money network typically incurs a higher charge than sending within the same network. This charge can vary based on the amount transferred and the specific networks involved.

- Intra-Network Transfers: Sending money to another account within the same mobile money network usually attracts a lower fee, often a flat rate regardless of the amount.

- Bank Transfers: Transferring money from a mobile money account to a bank account generally involves a higher charge than sending money within the mobile money system. This charge might be a fixed percentage or a combination of a fixed fee and a percentage of the transaction amount.

2. Receiving Money:

- Receiving Money: Typically, receiving money does not incur any charges for the recipient. However, certain promotions or specific offers might involve a small fee for receiving funds.

3. Cash-In and Cash-Out:

- Cash-In: Depositing cash into a mobile money account usually involves a fee, which can vary depending on the amount deposited and the agent involved.

- Cash-Out: Withdrawing cash from a mobile money account also attracts a fee, typically a percentage of the amount withdrawn, with a minimum charge often applicable.

4. Merchant Payments:

- Merchant Payments: Paying for goods and services through mobile money at merchants often involves a transaction fee, which can be a fixed amount or a percentage of the purchase amount.

5. Other Services:

- Airtime Top-up: Topping up mobile phone airtime through mobile money usually involves a small fee, which can be a percentage of the amount topped up.

- Bill Payments: Paying bills through mobile money often involves a fixed fee, which can vary depending on the bill type.

- Other Services: Various other services, such as insurance payments, lottery purchases, and money transfers to other countries, may also incur specific charges.

Understanding the Importance of Momo Charges

Momo charges are not merely a cost of doing business but play a crucial role in the mobile money ecosystem. These charges contribute to:

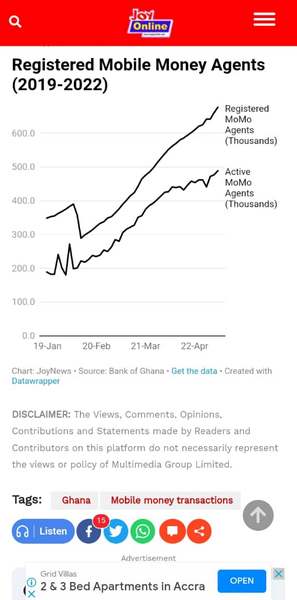

- Operational Costs: Mobile money service providers incur significant costs in maintaining the network infrastructure, processing transactions, and ensuring security. Charges help offset these operational expenses, ensuring the sustainability of the service.

- Profitability: Like any business, mobile money providers aim to generate profits. Charges are a key revenue stream, allowing them to invest in technological advancements, expand services, and offer competitive rates.

- Financial Inclusion: Charges can be strategically structured to promote financial inclusion by making mobile money services accessible to a wider population, particularly those in underserved communities.

Frequently Asked Questions (FAQs) about Momo Charges

1. What are the most common Momo charges?

The most common Momo charges include fees for sending and receiving money, cash-in and cash-out transactions, merchant payments, and airtime top-up.

2. Are there any ways to avoid Momo charges?

While avoiding all charges is not possible, certain strategies can help minimize them. These include sending money within the same network, utilizing free promotional offers, and choosing agents with lower fees.

3. How do I find out the specific charges for a transaction?

Most mobile money service providers offer detailed information on their websites, mobile apps, or through customer service channels. Additionally, agents often display the applicable charges for different transactions.

4. Can I negotiate Momo charges?

Generally, Momo charges are fixed by the service providers and are not typically negotiable. However, specific promotions or offers might allow for reduced charges during certain periods.

5. Are Momo charges regulated by the government?

The Bank of Ghana, the country’s central bank, regulates the mobile money sector, including the charges levied by providers. These regulations aim to ensure transparency, fair competition, and consumer protection.

Tips for Managing Momo Charges Effectively

1. Compare Charges: Before choosing a mobile money service provider, compare the charges for various services to find the most cost-effective option.

2. Utilize Promotional Offers: Take advantage of free or discounted services offered during promotions or special occasions.

3. Choose Agents Wisely: Opt for agents with lower cash-in and cash-out charges, as these fees can significantly impact your overall costs.

4. Use the Mobile App: Utilizing the mobile app for transactions often comes with lower charges compared to using USSD codes or agent services.

5. Plan Your Transactions: Consider grouping multiple transactions together to minimize the number of charges incurred.

Conclusion

Mobile money has transformed the financial landscape in Ghana, offering unparalleled convenience and accessibility. While Momo charges are an inherent part of the system, understanding their intricacies and implementing effective management strategies can significantly enhance the benefits of this transformative technology. By staying informed, comparing options, and utilizing available resources, individuals can maximize the value of mobile money while minimizing the impact of associated charges.

Closure

Thus, we hope this article has provided valuable insights into Mobile Money in Ghana: A Comprehensive Guide to Charges and Fees. We appreciate your attention to our article. See you in our next article!